Growth and sustainability of different startup-ants within the colony of innovative startups are determined by the business models they designed, and the roadmap chosen by their founding antrepreneurs [“An Antrepreneur is the combination of Ant-Entrepreneur. He or She is a person who combines both the personal characteristics and creative traits of an entrepreneur alongside the characteristics of the ants Smart Swarm inside their colony.” The Antrepreneur is the name given to Entrepreneurs in the Ants Colony Business Model presented in the book called The Colony of Innovative Startups[i]]

In this article, I will present to you a variety of business models available for startup to secure a sustainable path for development and growth. The different choices made by the antrepreneurs regarding the direction where to drive their startups are mainly financially related. Funding can turn simple ideas into genius solutions to the customers problems.

But! How hard is it for an antrepreneur to secure enough funding for his start-up’s development without drastic repercussions?

Startup-ants are invited to carefully choosing the right business model that helps them reaching markets where to test and validate their offers. It is only in the markets where innovative ideas can be validated as proven solutions for multiple problems that customers are facing.

Many entrepreneurial success stories come from companies that put customers at the heart of their business’ strategy. Companies that target customers’ needs, set up customer-oriented objectives, have so far secured their growth, and sustained their existence. Companies working hard to win positive feedback from customers gained can reach wider markets. Negative feedback from customers can hinder the development of the company and reduce its chances of survival in a highly competitive market.

“You do not have to be an expert to realize that! Just look around the most successful stories of entrepreneurs, they never asked for a single coin to start their adventures.”

A good training and mentoring program are the main determinant of the future outcomes of any entrepreneurial initiative. Depending on the strategic choices made by the antrepreneurs during the validation process of their innovation ideas, which can be turned into successful innovative startup or failed entrepreneurial experiences.

Antrepreneurs are invited to carefully draw their Business Plans and consider the best business models that focus on customers and market expansion first. Traditional business models are based on the capital investment needed to grow a business but overestimating such a choice might be risky and will have negative consequences. Taking somebody else money, applying for loans, or approaching investors are always time-consuming, which comes with risky, and unpredictable results.

Indeed, there are multiple ways of funding a start-up, but the consequences and outcomes of such funding are also different. The antrepreneur are advised to be aware of existing possibilities of funding their startup-ants. They should choose a sustainable model that gives leverage to the start-up and link it directly to potential customers. A source of funding that does not disperse the focus of antrepreneurs from product development to solving financial disputes with different investors. In fact! According to many experts in the field of funding startups acknowledge that investments injected, such as early-stage seeds, and funding rounds from different Venture Capitals (VCs) or Business Angels (BAs) rarely succeed!

In my opinion, the risk is higher for a start-up to spend high amounts of funding on developing a product without having the market feedback. In the end, it is not the VCs or BAs who are buying your products they only keep pressing antrepreneurs to deliver, it is indeed the customers who are paying for the start-up products. The most effective way to seek funding from VCs of BAs is at the growth phase, where start-up have clear insights its resources, as well as the end-customer reactions to its offer.

You may ask the question: who help antrepreneurs raising funding for the early development of his product or service?

The answer is simple: There is a bunch of flexible forms of financial support for lean startups, which provides institutional capital less risky than the funding from VCs or BAs.

The safer alternative is to be found in funding the start-up operations without outside money. Using the common customer-funded business models. I would refer you to a book called Customers funded business models [ii], so you can have a deep understanding of the five (05) novel approaches (called models).

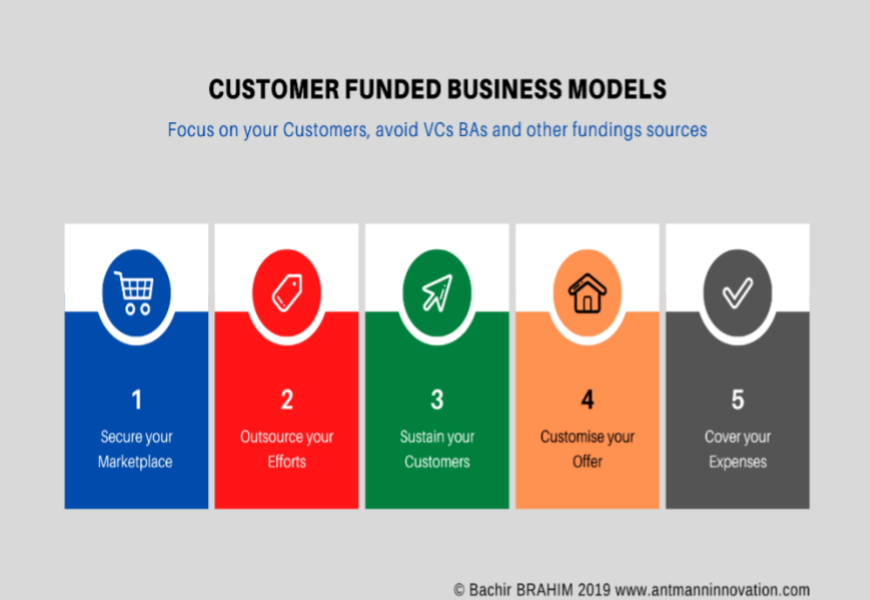

The logical and less dangerous way regardless of the start-up field of industry or its eventual size is to do the other way around.The reason why I do suggest the Customer-Funded Models — as it is shown in the next Figure — is the awareness of the negative impact of early-stage funding on startups. These models are supported by successful case studies of entrepreneurs who shaped the entrepreneurial world with the most innovative companies during the last thirty (30) years. These models have proven efficiency in practice and adopted by thousands of companies from around the world. I would provide a broad explanation of these models, in the hope that the future startups will reach the same legacy and success.

- Secure your Marketplace – The Matchmaker models.

- Outsource your Efforts – The Scarcity models.

- Sustain your Customers – The Subscription models.

- Customize your Offers – The Service-to-product models

- Cover your Operating Costs – The Pay-in-advance models

1. Secure your Marketplace with The Matchmaker models.

It is the type of business model that brings buyers and sellers together to make a commission when the transaction happens. No product is ever inventoried or sold by the start-up. It is based on the matching (linking together) the seller and the buyer at the same place! This model is effective for Web marketplaces for any goods or services. Eventually, an online platform developed by technology companies, such as VRBO, Uber, Booking.com, Hotel.com, Airbnb, eBay, Agoda, etc. Their business models are to play the mediator – a middleman – between the two sides and then earn fees or commissions from customers. Consequently, matchmaker models require fewer investments to build due to the existed relationship between sellers and buyers in each market.

2. Outsource Your Efforts with the Scarcity Models

Comparing to the previous models, scarcity is characterized by a unique for products and services, as well as limited availability. Scarcity, for intense, is a bit complicated because it involves more than two actors, which requires additional efforts of negotiations. This can allow startups to get a considerable number of prepaid orders at one. These models are based on a strategy using customers’ money to pay the operational cost of the production. It requires a time-based agreement between the seller of goods or service and the suppliers, which allows them to be paid after the sale is made. The product can be produced in advance at a lower cost. Such an agreement will give the seller the time to sell the product or service, get the profit, and later pay back the operational cost to the suppliers. These models are effective for specialty, collectible and luxury items. The success of these models is clear within the retail industry, such as the fashion industry like Zara clothing, or even the food processing industry, supermarkets for instance like Walmart, Carrefour, or Lidl.

3. Sustain Your Customer with the Subscription Models

These models have shaped many businesses for the last 30 years at least. It is based on a subscription relationship between the service or product provider and the final customer called subscriber. The customers pay for the startup-ant products on an ongoing monthly subscription basis. Such a subscription contract will allow the subscriber to receive the service or product regularly. These models typically have a low cost of service delivery and can become a reliable source of income for every start-up. Depending on the length of the period of subscription, which covers weeks, months, or even years, the subscriber will agree to pay repeatedly the entire fees in advance. These models are effective for consumable products, information marketing, or maintenance services, such as your mobile-phone package; newspaper, periodicals, or magazines; your Netflix package; a shaving box from Harry’s that delivers razor blades monthly, or even a selected box containing your outfit of the month.

4. Customize Your Offers with the Service-To-Product Models

These models are destined for companies in which their business lifecycle begins by providing customized services and eventually draw on their accumulated expertise to deliver packaged solutions to established companies. The businesses using service-to-product models are those who provide customized services to deliver solutions to another industry, on a complimentary basis. Both sides could not survive without mutual collaboration. These models are effective for all types of service businesses. Service provider platforms like Fiverr, Elance, TaskRabbit, or Indiegogo are good examples. It is the place where antrepreneurs can list the business offering for free and promote their startups. The case of collaboration between Microsoft and IBM in the early ’80s is the first documented example, where Microsoft offered the development of software needed to operate IBM machines in different industries. Both the hardware and the software are complementary to ensure the functioning of a machine or a device.

5. Cover Your Operating Costs with the Pay-In-Advance Models

These models are perhaps the most common model. Traditionally known in several industries, when customers order the product, they agree to pay a deposit in advance before delivering the final product or service. Individual professions like architects, consultants, freelancers, or even some contractors are perfect examples that reflect the pay-in-advance. They can use the upfront money received from customers to pay the operational cost. These models are effective for product distribution, service professionals, and custom products. The main characteristic of these models is the agreement between the two sides. Another concrete example of these models is the high-end furniture business that requires 50 to 100 percent advance payment at the time of order.

The lesson we can learn from the above-presented customer-funded business models is that any customer-oriented design is a survival strategy for every antrepreneur. It will serve as a roadmap, or a secret recipe to grow and sustain every startup. Financing the startup operations and product development through customers’ money, and not VCs or BAs is a smart choice with more advantages and measured risk.

To allow a more challenging Entrepreneurial Experiment. Antrepreneurs are strongly encouraged to focus on customer-funded business models during the starting and development phases of their Startups. They are free to require to VCs, BAs, and other types of funding in a later stage of business expansion and development. Such a choice will add more freedom to antrepreneurs in the way they pursue their entrepreneurial journey, and focus on the development of their startup-ants instead of pleasing the investors’ shifting mood.

In my opinion, VCs, BAs, and other types of investments as a tool for funding startups at an early stage of development, will harm the entrepreneurial experiment of the antrepreneurs. It will kill the entrepreneurial dream very early, and won’t give it time to be a more challenging journey. Studies show that most of the seed rounds of early stage funding for innovative ideas didn’t add a significant value to the start-up but accelerated its transition to a more complexe organizational governance model, then disapeared through merger & acquisition operations. A sad ending for an entrepreneurial dream!

References

[i] Bachir Brahim; The Colony of Innovative Startups: A Practical Guide for Policymakers and Corporate Leaders; KDP Amazon, 2020.

[ii] John Mullins; The Customer Funded Business; NY; John Wiley & Sons; 2014.